Taxable Gift Limit 2025 - Cmcss School Supply List 2025. 1 (4 oz.) bottle liquid… Taxable Gift Limit 2025. The united states government imposes a gift tax on gifts of money and other property that exceed the annual gift tax limit of $18,000 in 2025. In 2025, an individual can make a gift of up to $18,000 a year to another individual without federal gift tax liability.

Cmcss School Supply List 2025. 1 (4 oz.) bottle liquid…

T200018 Baseline Distribution of and Federal Taxes, All Tax, The federal lifetime gift and estate tax exclusion will increase for 2025, with possible increases for 2025 and 2025. In 2025, the limit is $17,000 per individual.

You have no exemption left. In 2025, you can make annual gifts to any one person up to a maximum of $17,000 per year ($18,000 in 2025, estimated to be $19,000 in 2025).

Annual Gift Tax Limit 2025 Aleda Aundrea, Individuals with taxable incomes over rs 3 lakh. Annual federal gift tax exclusion.

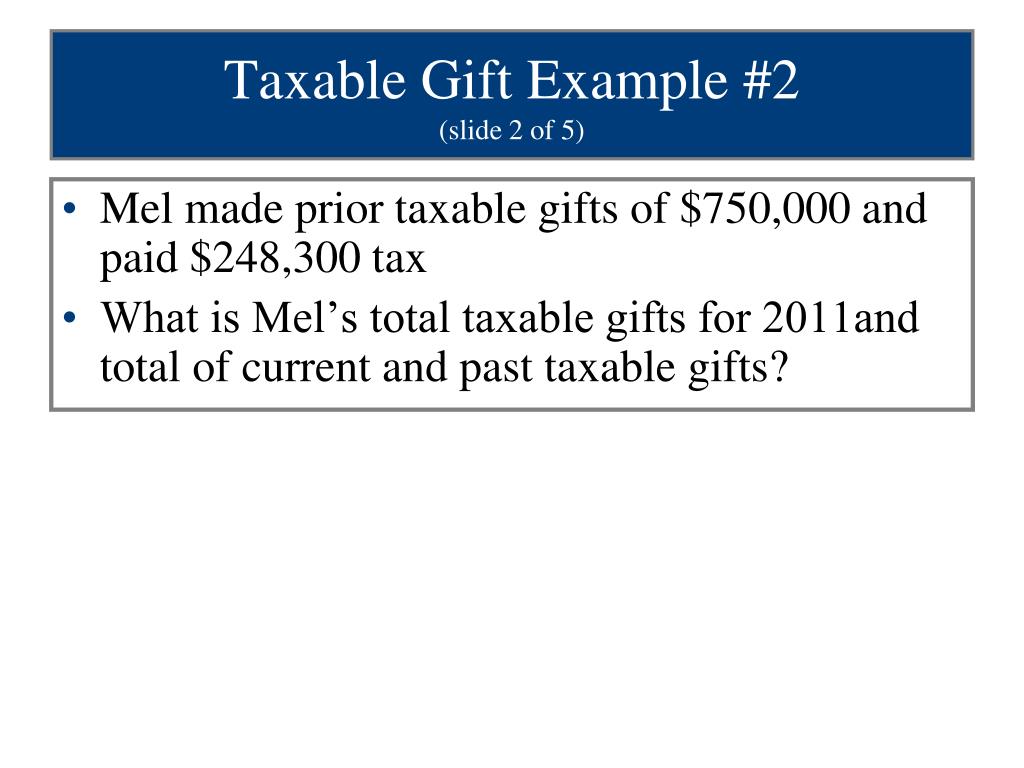

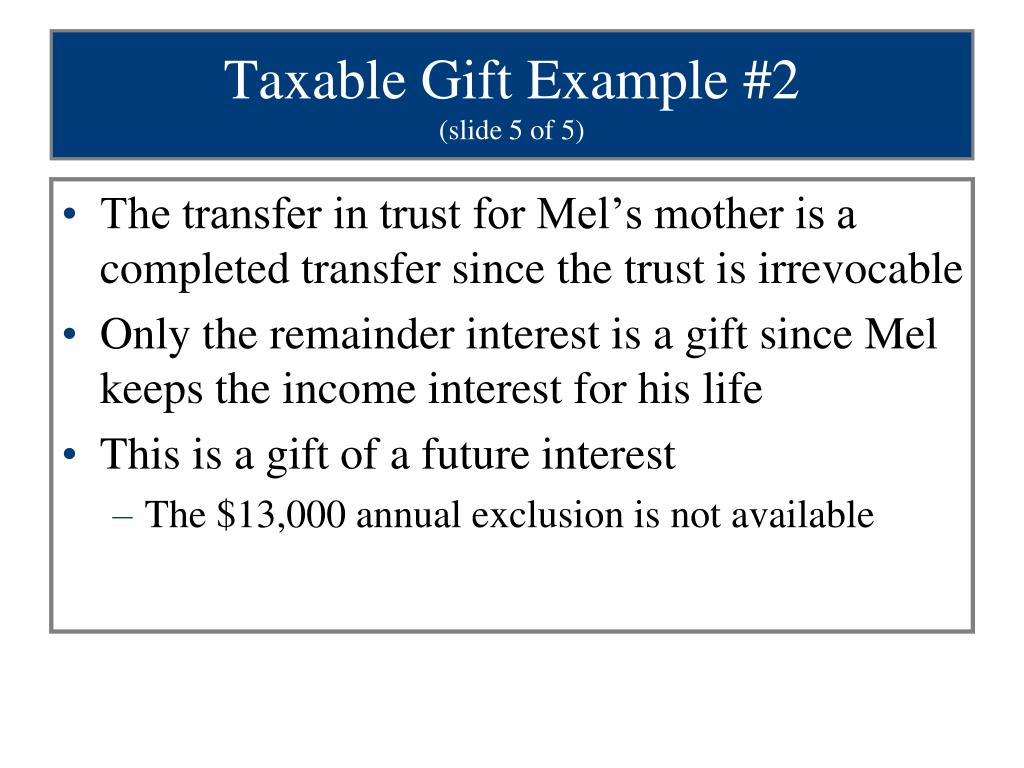

PPT Chapter 18 PowerPoint Presentation, free download ID4168152, In 2025, an individual can make a gift of up to $18,000 a year to another individual without federal gift tax liability. In 2025, the limit is $17,000 per individual.

In 2025, the internal revenue service (irs) increased the limits for both the gift tax exclusion and the lifetime estate and gift tax exemption to the highest amounts in.

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, The current estate and gift tax exemption law sunsets in 2025, and the exemption amount will drop back down to the prior law’s $5 million cap, which when. The federal annual gift tax exclusion also increased to $18,000 per person.

Annual Gift Tax Limitations Advantage One Tax Consulting, The united states government imposes a gift tax on gifts of money and other property that exceed the annual gift tax limit of $18,000 in 2025. You have no exemption left.

Gift Tax Wedding, But because the tcja sunsets on december 31, 2025, the estate. What you need to know.

Pin on, In 2025, an individual can make a gift of up to $18,000 a year to another individual without federal gift tax liability. In 2026, the limit drops to $7 million.

PPT Chapter 18 PowerPoint Presentation, free download ID4168152, In 2025, the limit is $17,000 per individual. You have no exemption left.

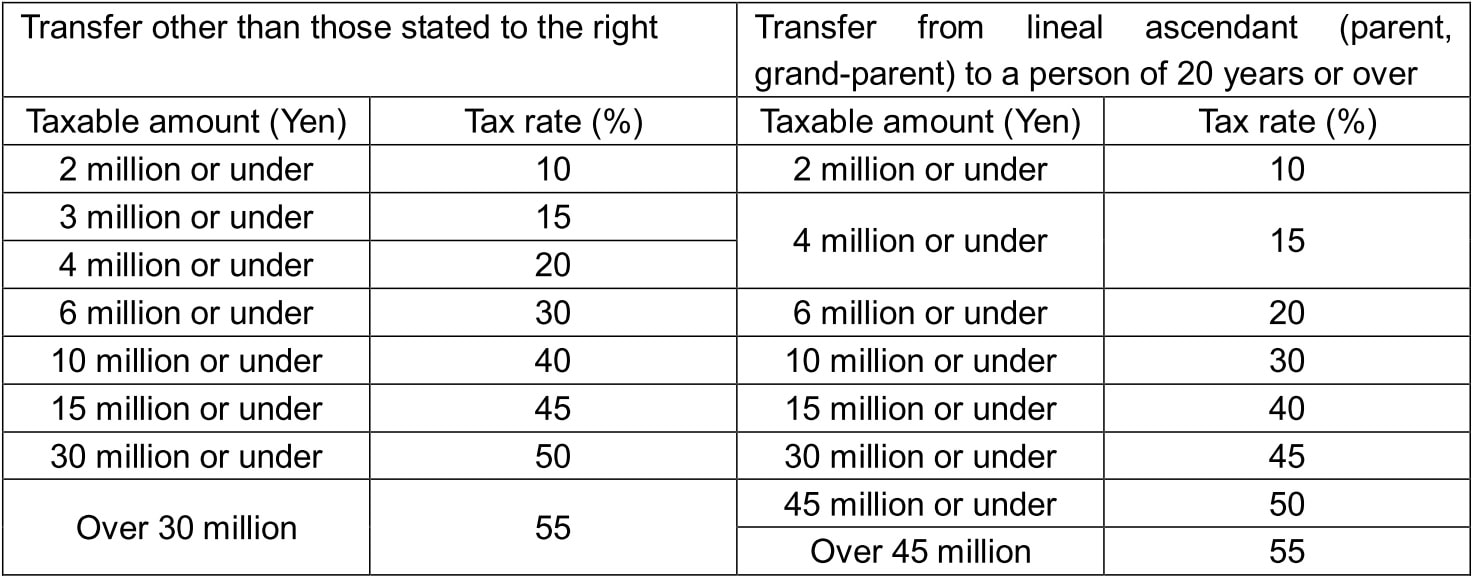

Taxes on Gifts and Inheritances Arrows International Realty, Making outright gifts now will reduce the taxable estate and can be. 50,000 per annum are exempt from tax in india.

Tax Gift, For example, suppose you gift $7 million in 2025 when the individual limit is $13.61 million. In 2025, the internal revenue service (irs) increased the limits for both the gift tax exclusion and the lifetime estate and gift tax exemption to the highest amounts in.

Futbol Femenino Mundial 2025. El torneo, en el que participarán…

Ny Flooding 2025. A state of emergency has been declared…